The first real-time credit bureau

We provide a single API for lenders to search, report and manage credit information.

We help credit risk teams improve their lending performance

Real-time signal for any lender to increase profitable lending

Our innovative products help partners increase conversion and expand their footprint with the confidence to increase responsible lending to new populations while still managing risk.

Helping to reduce default and fraud

Work with our team of risk experts, engineers and product managers to control losses and reduce default rates with real-time credit risk and fraud signal.

Improve consumer and regulator outcomes

Improve customer satisfaction and regulatory compliance while supporting Consumer Duty obligations with transparent, fair, and responsible lending practices.

Bureau data is incomplete, misleading and out of date

Financial services are hamstrung by bureau products that are “good enough", offering incomplete and potentially inaccurate consumer profiles.

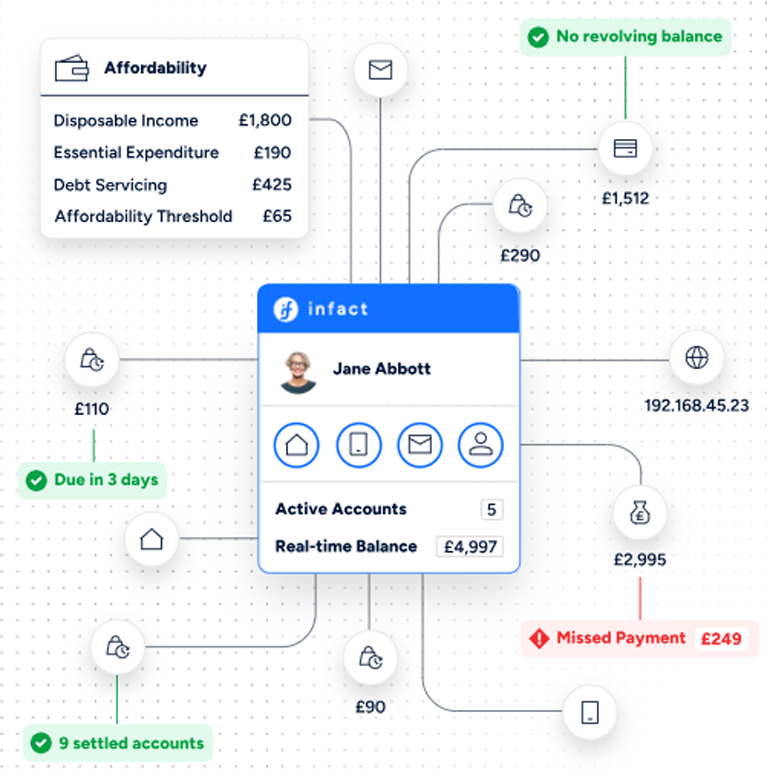

A comprehensive single-customer view

Infact is leading reform and driving innovation in the consumer credit information market by establishing a modern credit bureau to enhance the quality and speed of credit information.

Products

Augment your risk decisioning with products built for new lending, portfolio management, and compliance use.

Affordability

- Unlock new lending opportunities with more personalised affordability assessments.

- Increase acceptance rates by lending to new customer segments.

- Reduce manual underwriting and accelerate application processing.

- Strengthen regulatory compliance with explainable data.

Fraud

- Streamline customer onboarding while enhancing fraud protection.

- Monitor real-time risk signals across lender networks.

- Detect synthetic identities and reduce application fraud.

- Includes risk scores, reputation levels, device and behaviour intelligence.

Credit Risk

- Optimise lending decisions with real-time credit signal.

- Increase approval rates by identifying creditworthy thin-file applicants.

- Spot loan stacking and emerging risks in real-time.

- Boost customer lifetime value with smarter credit limit management.

A bureau built to represent today’s consumer

Accurately represent modern credit

Our bureau captures the nuances of products like BNPL, providing a more complete picture of consumer credit behaviour. This leads to improved lending decisions and better portfolio performance for lenders.

Align with Consumer Duty

Real-time data helps lenders meet Consumer Duty requirements more effectively, enabling better protection of vulnerable individuals and promoting responsible lending practices, resulting in better outcomes for consumers.

Secure and compliant

Infact is engineered with security and data protection at its core. We're FCA authorised, ISO 27001 certified, and undergo rigorous audits and pentests to ensure your data is protected by industry-leading controls.

Loved by Developers

Infact is the credit bureau for credit risk teams that want practical innovation and collaboration.

One single API

Search, report and manage credit information through a single integration that takes hours not months.

Developer portal

Full API guidance and reference, with a sandbox environment ready for developing your integrations.

API examples

API demonstrations, a Postman collection, and example personas for each integration scenario.

Deploy and iterate quickly

Rapidly deploy and scale your custom risk models using our developer-friendly APIs and expert support.

Calibration retros

Guidance and partnership to help you build, launch and continuously improve your risk policies.

Secure and reliable

Certified to world-leading standards, we protect data to the highest standards, with the most reliable availability.

Is your team ready for real-time credit data?

Authorised and regulated by the Financial Conduct Authority (FRN: 978629)

Infact is a trading name of Infact Systems Limited, registered in England and Wales (Company Registration Number: 14032664)

Registered address: 2-7 Clerkenwell Green, London, EC1R 0DE

'Infact' is a registered trademark of Infact Systems Limited. Copyright © Infact Systems Limited 2026. All Rights Reserved