Reporting to Infact

Start building a better bureau today

Begin with better data quality today, prepare for real-time tomorrow.

The Data Quality Crisis

Submission cycles delay ingestion by weeks, resulting in stale data that doesn't reflect consumers' financial situations.

90% of submissions require corrections, with 15-20% of credit files containing preventable formatting errors.

Legacy bureau formats struggle to accurately represent modern financial products like Buy Now Pay Later.

Over-reliance on electoral register data excludes consumers and leads to poor outcomes.

Delta

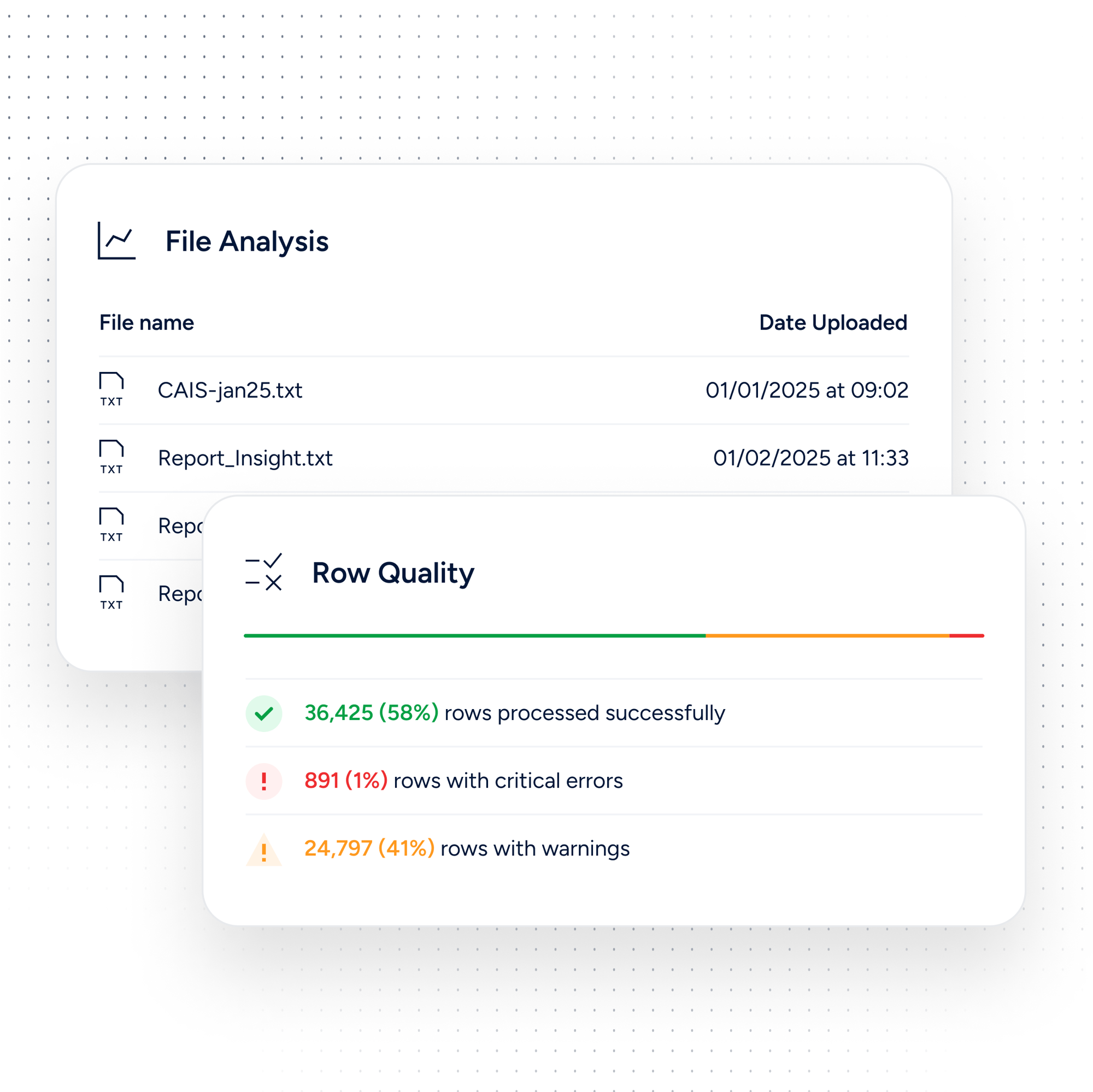

Improve data quality with Delta

Delta bridges the gap between these legacy systems and modern data quality requirements, catching errors before submission.

Business impact

Potential to cut reporting errors by 90% through pre-submission validation and improve data accuracy in bureau submissions.

Reduce file analysis time by up to 70% and reduce the burden of manual corrections and bureau communications.

Delta dramatically reduces the traditional credit file update cycle, slashing the report-to-ingestion window by up to 85%.

How it works

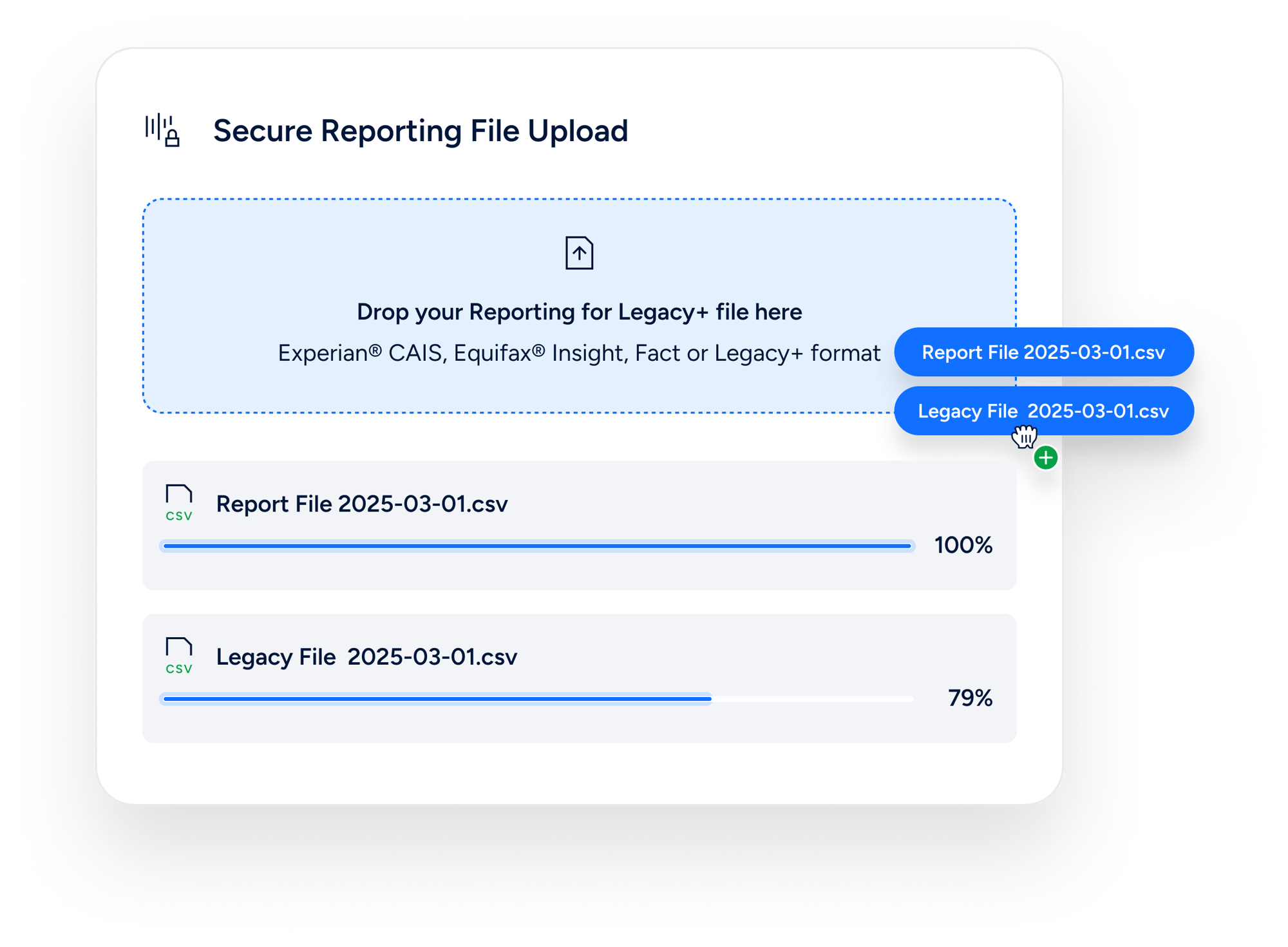

Begin your journey with implementation that takes just hours, delivering immediate improvements to your reporting workflow.

Delta bridges the gap between legacy reporting systems and modern data standards, establishing a foundation for continuous improvement.

Experience correction cycles reduced from weeks to hours and immediate ROI from your very first reporting cycle.

Seamlessly enables lenders to begin reporting into Infact with a user-friendly interface that simplifies the process of sharing credit data.

Making real-time a reality

Infact is transforming credit reporting with cutting-edge technology and a fresh approach.

Our API-based architecture enables lenders to report, update and amend accounts instantly, allowing us to maintain the most accurate view of a individual’s credit exposure.

Our reporting format accurately captures the details of contemporary financial products, including BNPL features like early payments and payment adjustments.

We support a wide range of identifiers, including email and mobile numbers, for a more inclusive and accurate picture.

The Infact API allows for instant updates and amendments to credit records, ensuring refunds and early repayments are promptly reflected.

Our approach focuses on individuals rather than addresses, creating a more holistic and fair representation of creditworthiness.

Our platform scales to deliver real-time credit information with on-demand insights. All with sub-second response times, and the highest levels of compliance and data protection.

We offer clear documentation and support for a smooth integration process, reducing time-to-value for lenders. Benefit from onboarding in days, not months.

Align with Consumer Duty

Real-time data helps lenders meet Consumer Duty requirements more effectively, enabling better protection of vulnerable individuals and promoting responsible lending practices, resulting in better outcomes for consumers.

Supporting a better financial services industry

Infact's innovative credit reporting system delivers more timely, accurate data, enabling lenders to make smarter decisions while helping consumers build stronger financial profiles.

Our reporting capabilities provide lenders with more timely and accurate data, offering significant advantages across various aspects of their operations:

Spot issues like loan stacking earlier, lowering expected credit losses and improving overall credit performance.

Reveal creditworthy customers often overlooked by traditional systems, potentially increasing acceptance rates.

Gain an edge in the market by pricing risk more accurately, offering more competitive APRs and offers to customers.

Reduce integration time and costs that contribute to lowering operational costs and improving operational efficiency.

Receive fewer requests and complaints from individuals ultimately delivering better customer satisfaction.

Better protect vulnerable individuals and promote responsible lending practices, resulting in better outcomes for consumers.

Infact's innovative reporting system offers numerous advantages for consumers:

More timely and accurate data leads to fairer lending decisions. These fairer decisions may result in lower cost of debt for consumers.

Provide consumers with a comprehensive view of their credit profile, empowering them to make informed financial decisions.

More timely reporting and the ability to accurately reflect BNPL helps individuals to build credit profiles faster, safer and cheaper.

Real-time reporting helps prevent consumers from taking on more debt than they can handle.

Faster corrections ensure a more accurate and up-to-date representation of consumers' financial situations.

Drive financial inclusion and contribute to a fairer, more efficient credit ecosystem while improving their key performance metrics.

Reporting via API

We offer a simple, intuitive API to service the entire reporting lifecycle.

01 Report

Report individuals and their accounts through real-time structured reporting with immediate validation and processing.

Used for:

- Details about people

- Unique identifiers

- Details about accounts

- Details about payment schedules

02 Update

Directly update an individual or an account’s status and payment performance using the same API.

Used for:

- Refunded purchase

- Balance amendment

- Payments

- Early payments

- Missed payments

- Delinquencies

03 Amend

Modify or correct any reported data automatically when issues are raised.

Used for:

- Corrections

- Resolving disputes

- Consumer requests

- Processing updates

- Missed persons or accounts

Infact’s News & Insights

Learn about the latest in reporting

Bureau Meets Mobile Intelligence: A Modular Identity API for Fintech Onboarding

If you run onboarding for a consumer fintech, you know the trade‑off: push customers through fast and you worry .

Zopa Bank and Infact partner to improve credit report accuracy

Infact has partnered with Zopa Bank to improve customers’ credit information accuracy and visibilit.

Infact joins the Consumer Credit Trade Association

We’re pleased to announce that Infact has joined the Consumer Credit Trade Association (CCTA), one .

Is your team ready for real-time credit data?

Authorised and regulated by the Financial Conduct Authority (FRN: 978629)

Infact is a trading name of Infact Systems Limited, registered in England and Wales (Company Registration Number: 14032664)

Registered address: 2-7 Clerkenwell Green, London, EC1R 0DE

'Infact' is a registered trademark of Infact Systems Limited. Copyright © Infact Systems Limited 2026. All Rights Reserved