Delta

Smarter reporting with Delta

End monthly reporting struggles with pre-submission validation and real-time load reports that significantly reduce correction cycles.

The problem

The current credit reporting process traps lenders in an inefficient submit-reject-correct cycle each month, consuming valuable resources and delaying accurate information from reaching credit bureaus.

The solution

Designed to be the first port of call in monthly reporting workflows, Delta transforms credit bureau reporting by identifying and reducing the amount of errors in all reporting formats before submission.

Business impact

Potential to cut reporting errors by 90% through pre-submission validation and improve data accuracy in bureau submissions.

Reduce file analysis time by up to 70% and reduce the burden of manual corrections and bureau communications.

Delta dramatically reduces the traditional credit file update cycle, slashing the report-to-ingestion window by up to 85%.

Product features

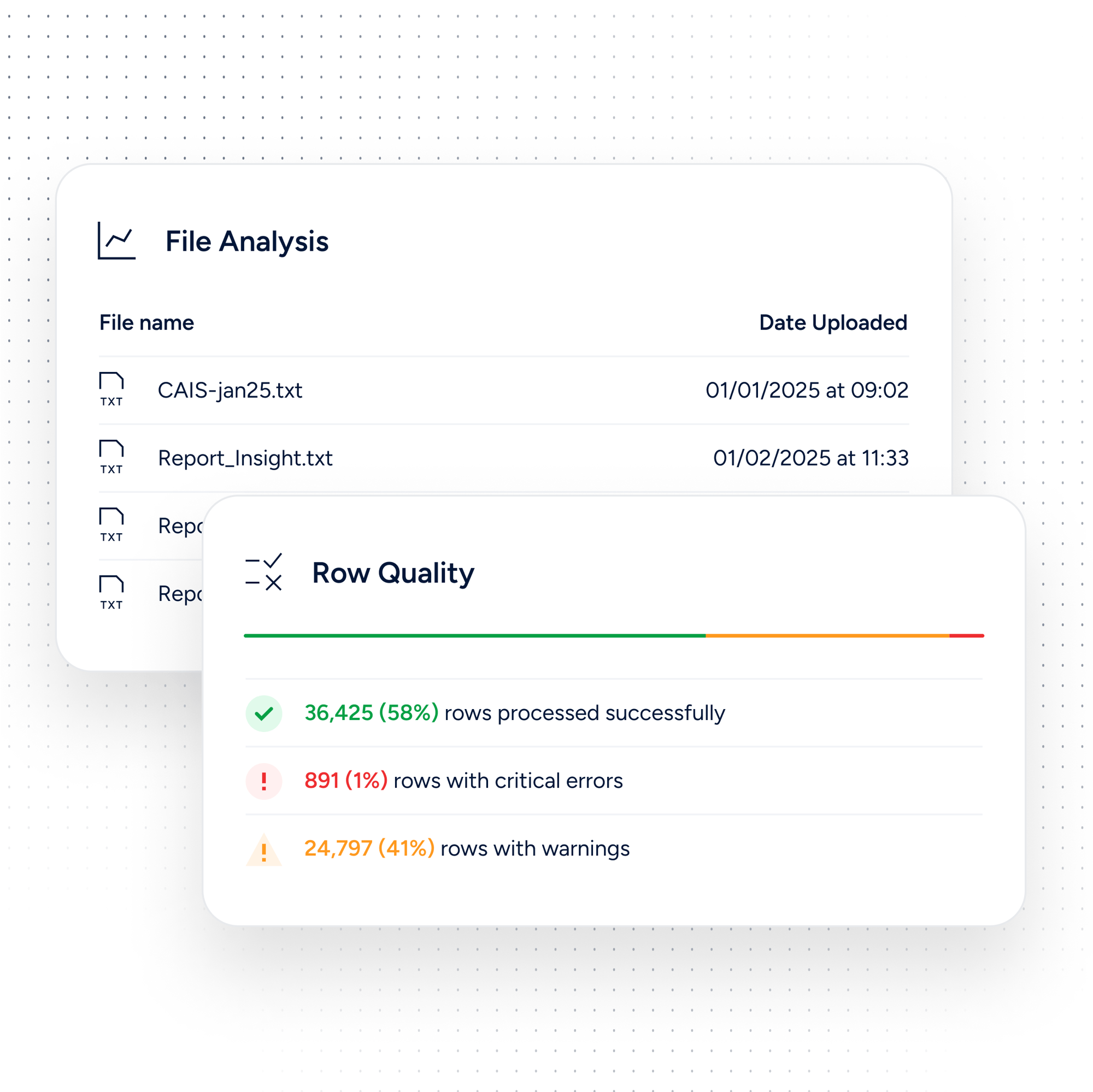

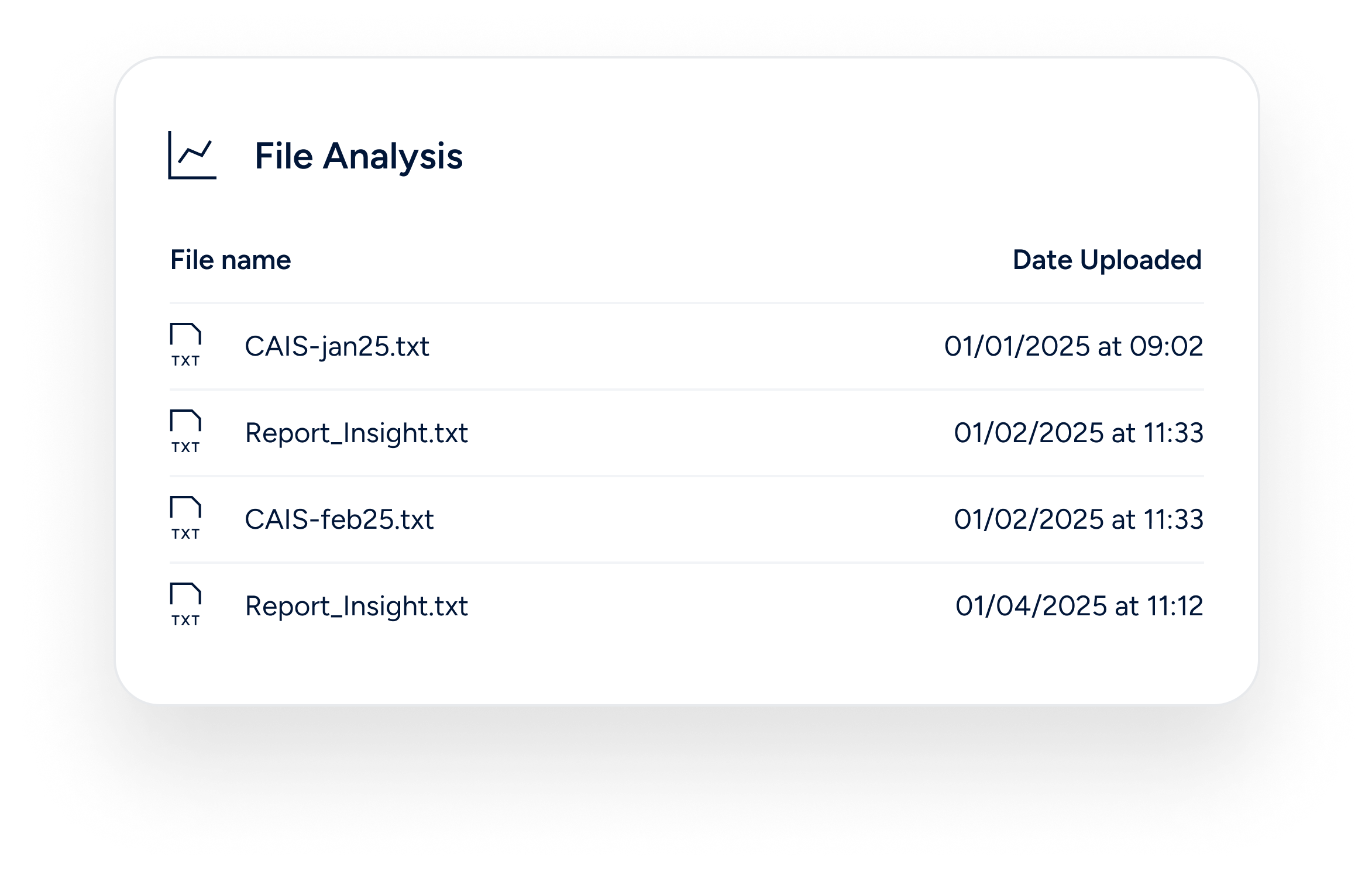

Find issues instantly

Submit any file format

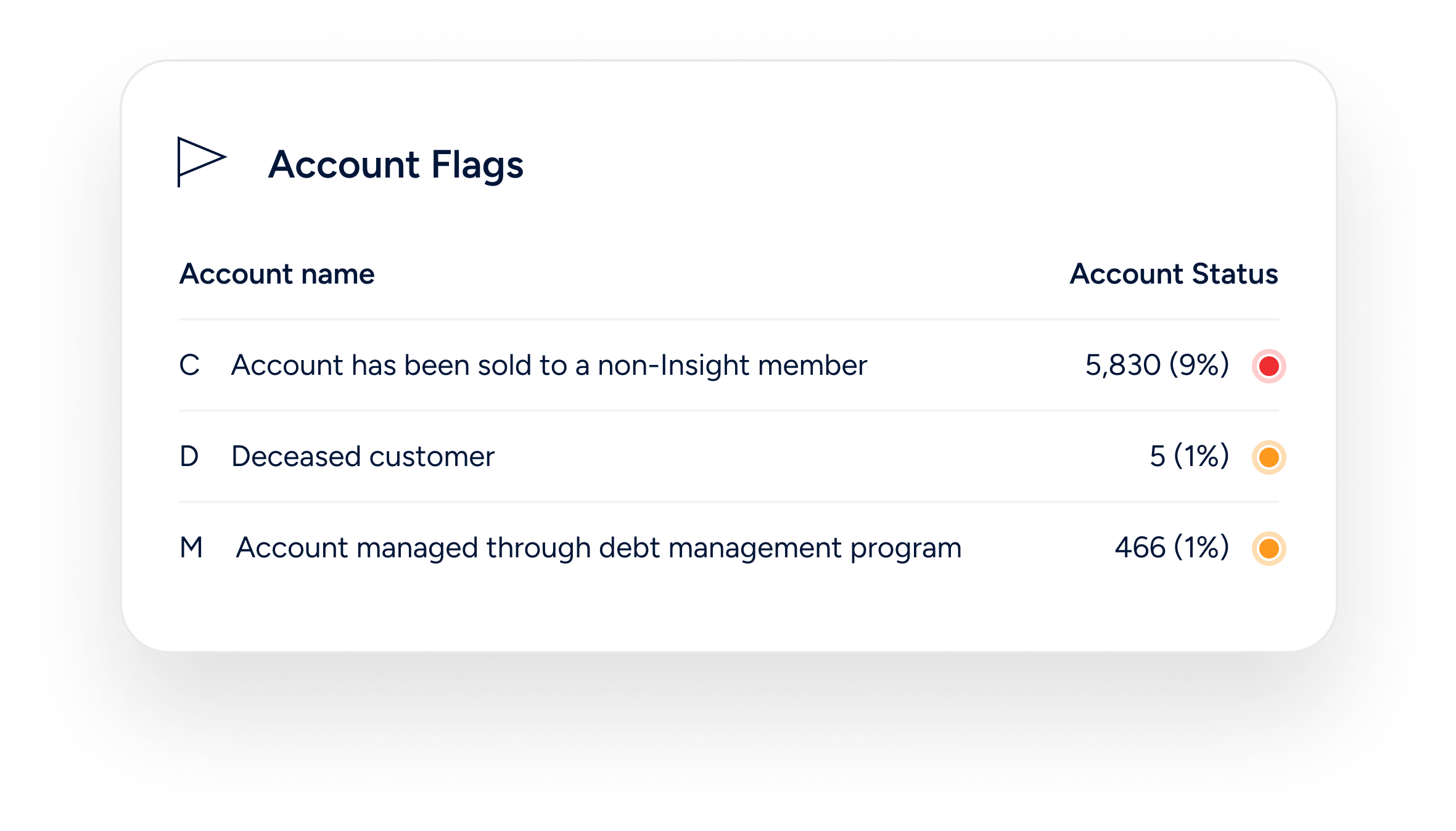

Proactive error detection

Continuous quality monitoring

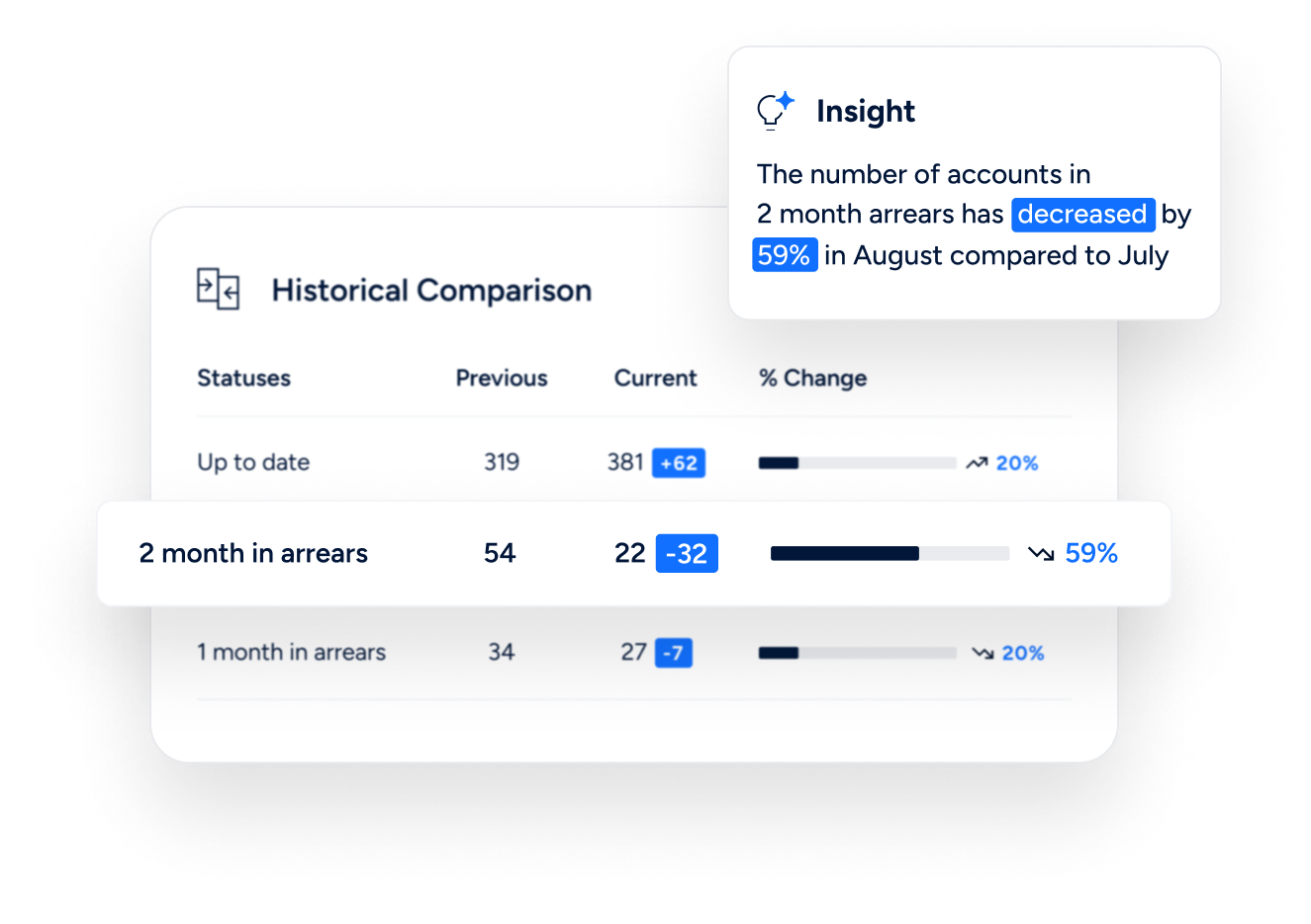

Monitor Changes Across Monthly Reports

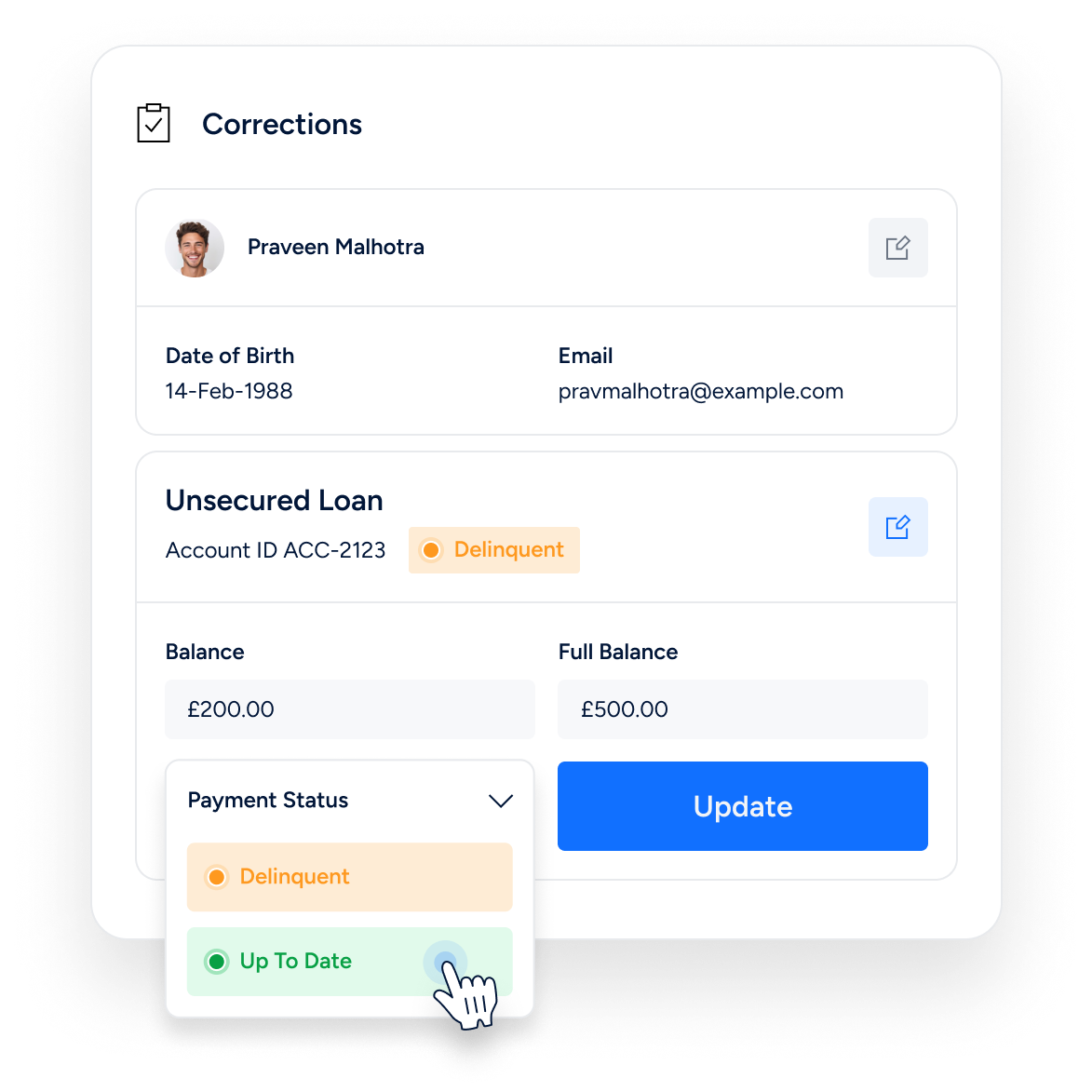

Instant Corrections

Enhanced security

Testimonials

"Delta is the first CRA data quality tool that the team have used that's built to be user-friendly. We're embedding it as part of the validation process before we send our CRA files."

"With Delta's pre-submission validation, we've significantly reduced the number of errors we receive in our load reports which has reduced our operational overhead."

Questions about how Infact can fit into your business?

Our team of experts can help you find the right solution. Fill out the form and we’ll get in touch shortly.

Infact Systems is committed to protecting and respecting your privacy, and we’ll only use your personal information to administer your account and to provide the products and services you requested from us. From time to time, we would like to contact you about our products and services, as well as other content that may be of interest to you. If you consent to us contacting you for this purpose, please tick below to say how you would like us to contact you:

For more information on how to unsubscribe, our privacy practices, and how we are committed to protecting and respecting your privacy, please review our Privacy Policy. By clicking submit below, you consent to allow Infact Systems to store and process the personal information submitted above to provide you the content requested.

Infact’s News & Insights

Learn about the latest in reporting

Bureau Meets Mobile Intelligence: A Modular Identity API for Fintech Onboarding

If you run onboarding for a consumer fintech, you know the trade‑off: push customers through fast and you worry .

Zopa Bank and Infact partner to improve credit report accuracy

Infact has partnered with Zopa Bank to improve customers’ credit information accuracy and visibilit.

Infact joins the Consumer Credit Trade Association

We’re pleased to announce that Infact has joined the Consumer Credit Trade Association (CCTA), one .

Is your team ready for real-time credit data?

Authorised and regulated by the Financial Conduct Authority (FRN: 978629)

Infact is a trading name of Infact Systems Limited, registered in England and Wales (Company Registration Number: 14032664)

Registered address: 2-7 Clerkenwell Green, London, EC1R 0DE

'Infact' is a registered trademark of Infact Systems Limited. Copyright © Infact Systems Limited 2026. All Rights Reserved