2 min read | Sep 30 2025

Over the last 10 years there has been both an increase in scrutiny on affordability assessments from the regulators and a deterioration in UK lenders ability to perform proportionate affordability assessments in the context of an individual credit application.

This has created a risk dilemma: Lenders want to lend responsibly and fairly but are struggling for the insights to do that effectively. This dilemma has been exacerbated by rising cost-of-living.

Having worked in consumer credit for decades, our team has recognised this as a critical pinch point for lenders in generating good outcomes for consumers and complying with regulations in a fair and responsible way and are pleased to announce the launch of our first product: Affordability Engine.

| Sub-second response time | 100% population coverage |

| 16% increase in acceptances | 48% reduction in referrals |

How it works

The Affordability Engine delivers a set of predicted Affordability Metrics that allow a lender to assess a borrower’s affordability in the context of a credit application. This is done by blending Infact’s proprietary Affordability Model Dataset with credit application data. The Affordability Engine provides a level of personalisation and context not available from other products in market.

Why affordability commands prioritisation now

Affordability assessments need to be more explainable.

- Consumer groups and regulators are increasingly focused on ensuring adequate affordability assessments are performed to protect consumers, especially the 12.9 million adults that have low financial resilience

- A 20% year-on-year increase in Affordability related complaints to the FOS over the last 10-years and perceived weaknesses in lenders ability to respond to complaints adequately

- Ongoing push for good outcomes for consumers in line with Consumer Duty.

To help with these challenges, Affordability Engine offers an industry-leading, application level Explainability Report that complements the Affordability Engine output, designed to support compliance requirements, complaint handling and monitoring.

If you want to learn more about our Explainability Report, book a meeting here.

Where Affordability Engine delivers value

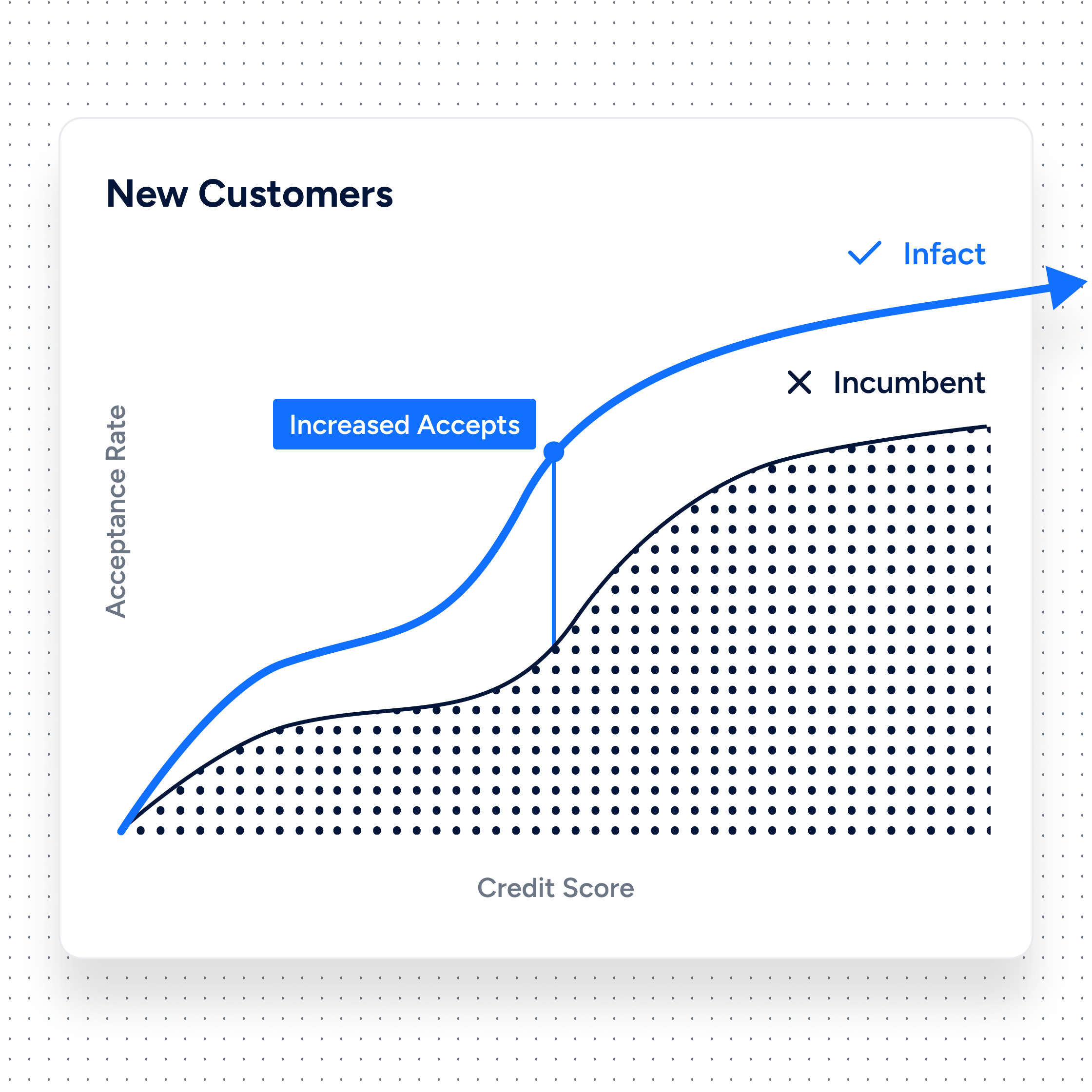

Affordability Engine is specifically designed for lenders who acquire customers through comparison sites and at checkout and has been proven to increase acceptances and reduce costs by:

- Enabling lending to new customer segments

- Introducing more informed affordability assessments higher up the funnel

- Reducing application friction and response times

- Reducing manual referrals

- Improving application funnel conversion

- Providing a more personalised prediction of expenditure and disposable income

- Improving explainability and complaint response processes

- Complementing existing methods of assessing affordability

"Infact's Affordability Engine has improved our expenditure assessments beyond what we could achieve with ONS, which has delivered meaningful increases in acceptances and automated decisioning while keeping application friction low."

Head of Lending, James Wilkinson, Fair For You

Learn more about Infact's Affordability Engine

*

Infact is Authorised and Regulated by the Financial Conduct Authority as a Credit Reference Provider and is committed to continuing to innovate and deliver in the consumer credit information market.

Infact Systems Limited (“Infact”) is registered in England and Wales (company number 14032664), at 2-7 Clerkenwell Green, London, EC1R 0DE. Infact is authorised and regulated by the Financial Conduct Authority (FRN: 978629)

Other articles you may be interested in

2 min read | Sep 30 2025

8 min read | Sep 20 2024

3 min read | Apr 02 2025

8 min read | Jan 21 2025

.png?width=352&name=Reeds%20Law%20Small@2x%20(3).png)